How we can help

Claranet’s PCI Qualified Security Assessors (QSAs) help organisations at every stage of their PCI DSS journey – whether you’re validating compliance for the first time, re-certifying annually, or making architectural changes to modernise your payment environment.

Why Claranet

Practical, pragmatic experts who never take a tick-box approach.

PCI DSS shouldn’t be about blindly following a list. Our QSAs understand the intent behind the requirements, which means we can help you meet the standard in ways that work in real environments.

Technical expertise

Our team is very technical, which makes a big difference when dealing with:

- Multi-cloud and hybrid infrastructure

- Hosted platforms and third-party payment service providers

- Tokenisation, P2PE, and secure card capture flows

- EPOS platforms and large distributed retail estates

Where deeper technical input is required, we can also pull in Cloud, Networking, and Security specialists from across Claranet to help solve the problem — not just point at it.

Built to support your wider security strategy

PCI DSS doesn’t sit on its own. Our QSAs also work with ISO 27001, NIST, NIS2 and other frameworks, so the advice you get will make sense in the context of your broader security and compliance efforts — not create duplicate work.

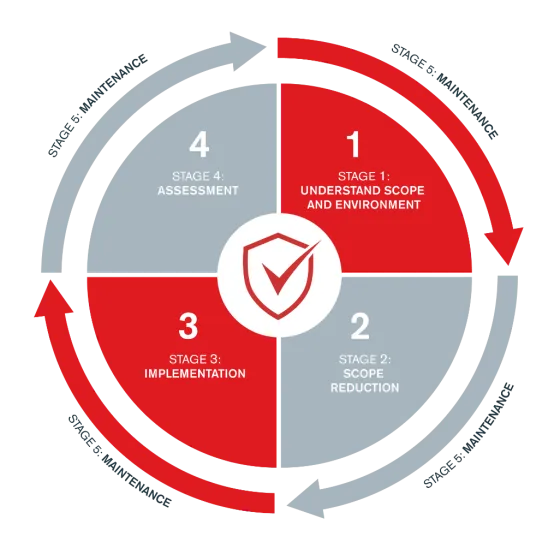

How we work

From this, we’ll produce a clear, realistic roadmap.

Before you start implementing controls or preparing for an assessment, it’s essential to understand exactly what is in scope. We begin with a Cardholder Data Environment (CDE) mapping exercise to:

- Identify payment channels and data flows

- Confirm whether you qualify for SAQ self-assessment or require a Level 1 ROC

- Determine which PCI requirements apply to your systems and third parties

- Highlight where scope can be reduced through redesign, segmentation, or process changes